A. Top 10 questions from the public

A.1. What is the AfCFTA?

According to Agenda 2063, the African Union's (AU) flagship project is the African Continental Free Trade Area (AfCFTA) [1] . It provides a member-driven road map for achieving sustainable and inclusive development on the continent. Its objective is to create an integrated market for the trade in goods and services, as well as the free movement of people and capital.

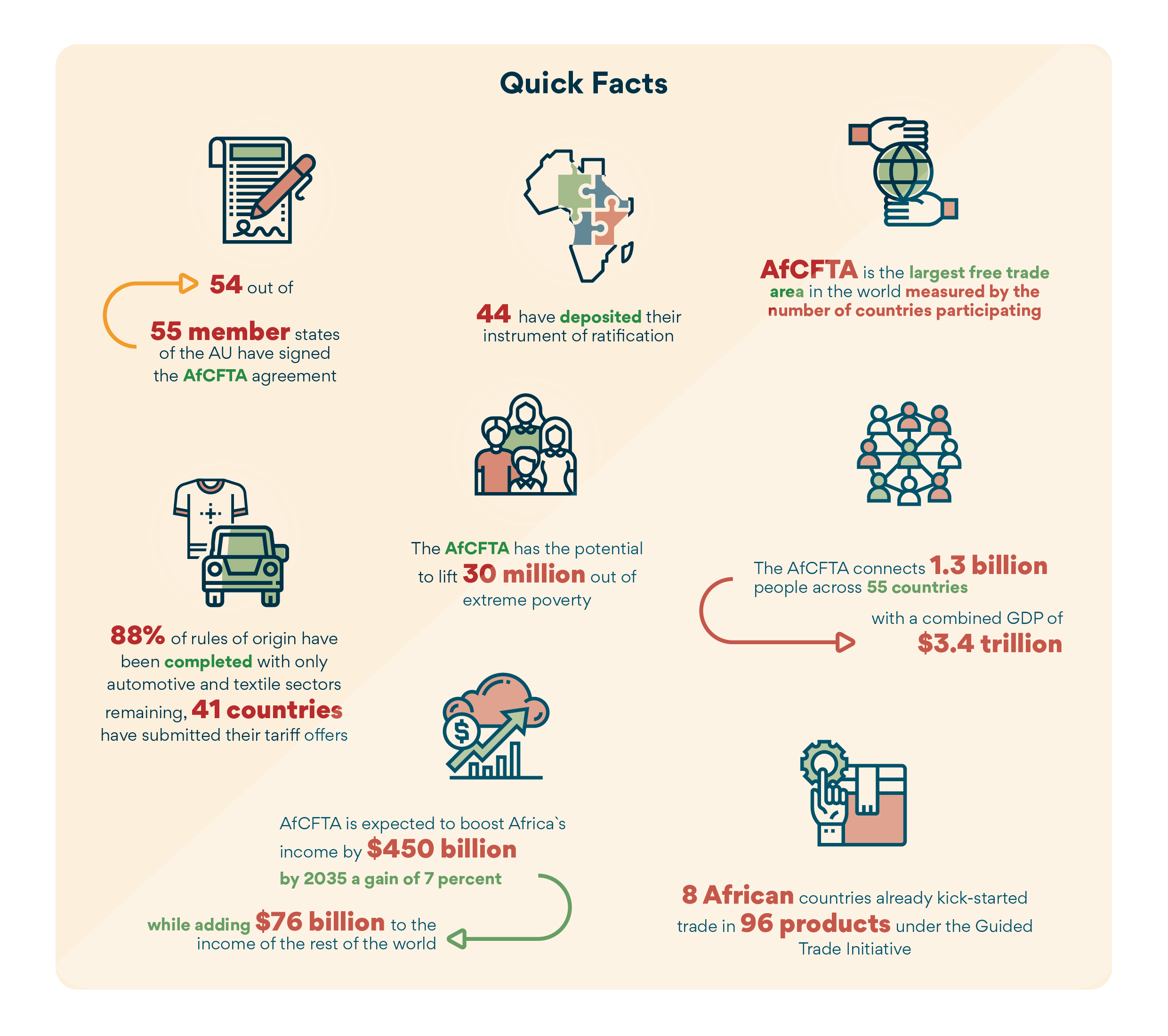

With a combined GDP of an estimated US$ 3.4 trillion, the pact links 1.3 billion people living in different parts of the continent, according to AfCFTA Factsheet .

The AfCFTA is the largest free trade pact in the world in terms of the number of signatories, which promises to turn Africa into a modern, industrialized, cohesive, and influential player on the global stage. Members are initially required to remove tariffs from 90% of goods per AfCFTA Tariff Modalities , eventually allowing free access to at least 97% of goods and most of services across the African continent.

In ITC's taxonomy of trade agreements, AfCFTA falls into the category of free trade agreements (FTA), as it liberalizes substantially all trade among participating countries. FTAs are the most common type of preferential trade arrangements and more than 300 are in force today per Rules of Origin Facilitator trade agreement database. FTAs are more ambitious than partial scope agreements, which only liberalize trade on a limited list of products. AfCFTA is not a customs union, as it does not adopt a common external tariff at the continental level towards third parties .

A.2. Why does Africa need the AfCFTA?

African trade integration has long been constrained by deteriorating border and transportation systems, as well as a patchwork of unique legislation in dozens of markets. Governments frequently create trade barriers to protect their home markets from regional competition, making trading with close neighbors more expensive than trading with nations considerably further away.

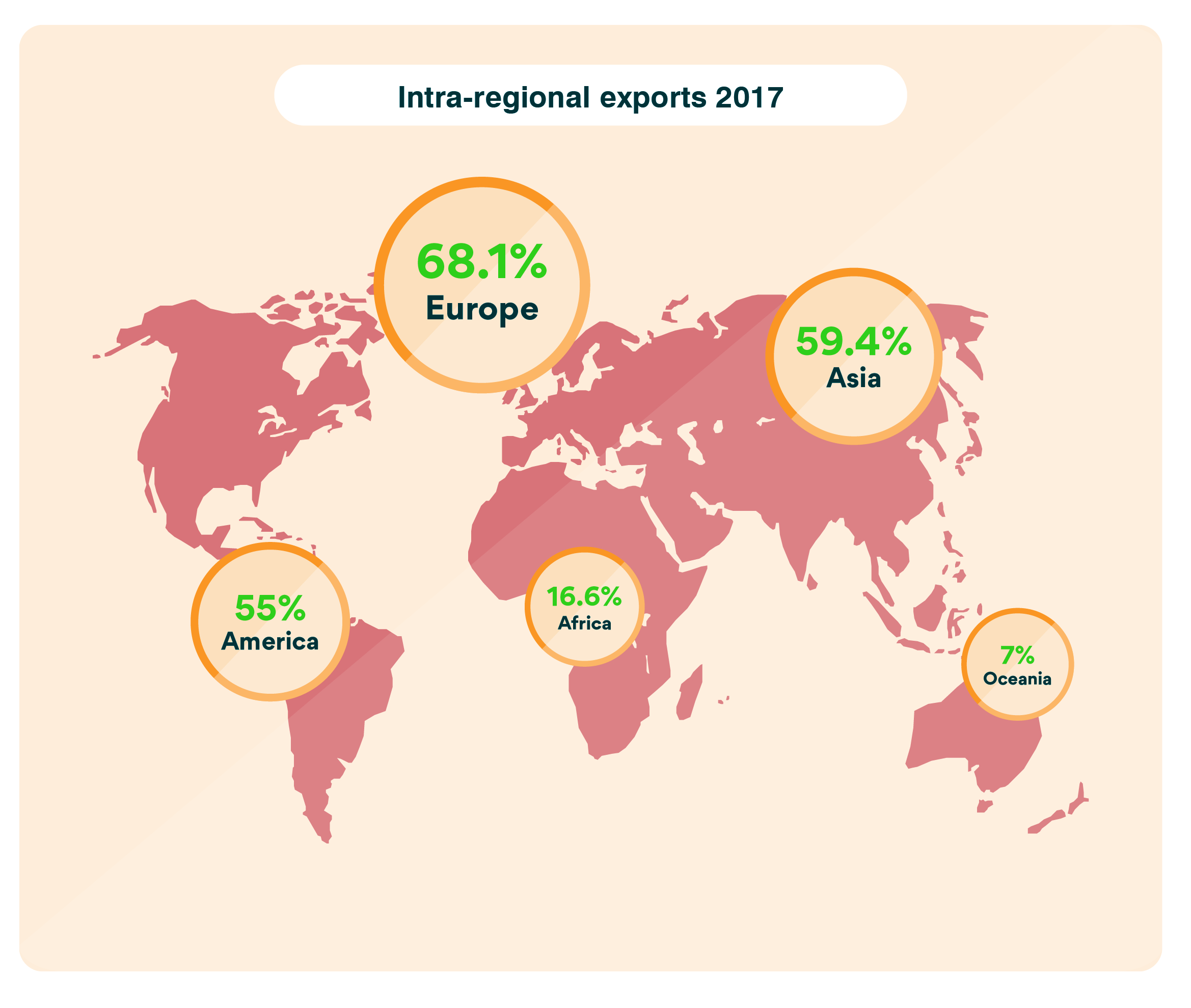

According to UNCTAD's Economic Development in Africa Report 2019 , intra-African exports made up 16.6% of all exports in 2017 compared to 68.1% in Europe, 59.4% in Asia, 55% in America, and 7% in Oceania.

The average of intra-African exports and imports, or intra-African trade, was roughly 15.2% between 2015 and 2017. The share of exports from Africa to the rest of the world ranged from 80% to 90% during the period from 2000 to 2017 - only Oceania had a higher export dependence on the rest of the world in that period [2] .

A.3. What are the milestones in the AfCFTA negotiations?

In 2012, the Assembly of Heads of State and Government of the AU (the successor of the Organization of African Unity - OAU) agreed upon the idea of the Continental Free Trade Area (CFTA). In January 2015, the AU launched its 50 years' vision & action plan "Agenda 2063: The Africa We Want”, which contains seven aspirations on several topics with regards to development, and the CFTA is one of the flagship projects of the First Ten Year Implementation Plan under the AU's Agenda 2063 [3] .

In June 2015, the AU's Heads of State and Government meeting started the negotiations toward a CFTA. Phase 1 of the negotiations has covered trade in goods and trade in services. Phase 2 will cover areas of Investment, Intellectual Property Rights and Competition Policy.

In January 2018, the name African Continental Free Trade Area (AfCFTA) was adopted by the AU. On 21st March 2018, the Agreement establishing the AfCFTA was adopted by the 10th Extraordinary Session of the Assembly in Kigali, Rwanda [4] .

A.4. When did the AfCFTA come into force?

According to Article 23 of the Agreement Establishing the African Continental Free Trade Agreement (AfCFTA), entry into force occurs 30 days after the 22nd instrument of ratification is deposited with the Chairperson of the African Union Commission (AUC) - the designated depositary for this purpose. The Agreement entered into force on 30 May 2019 for the 24 countries that had deposited their instruments of ratification by this date.

The operational phase of the AfCFTA was launched during the 12th Extraordinary Session of the Assembly of the Union on the AfCFTA in Niamey, Niger on 7 July 2019. Start of trading under the AfCFTA Agreement began on 1 January 2021, however, no trade has taken place until recently under the AfCFTA regime due to challenges in implementation such as completion of negotiations on rules of origin.

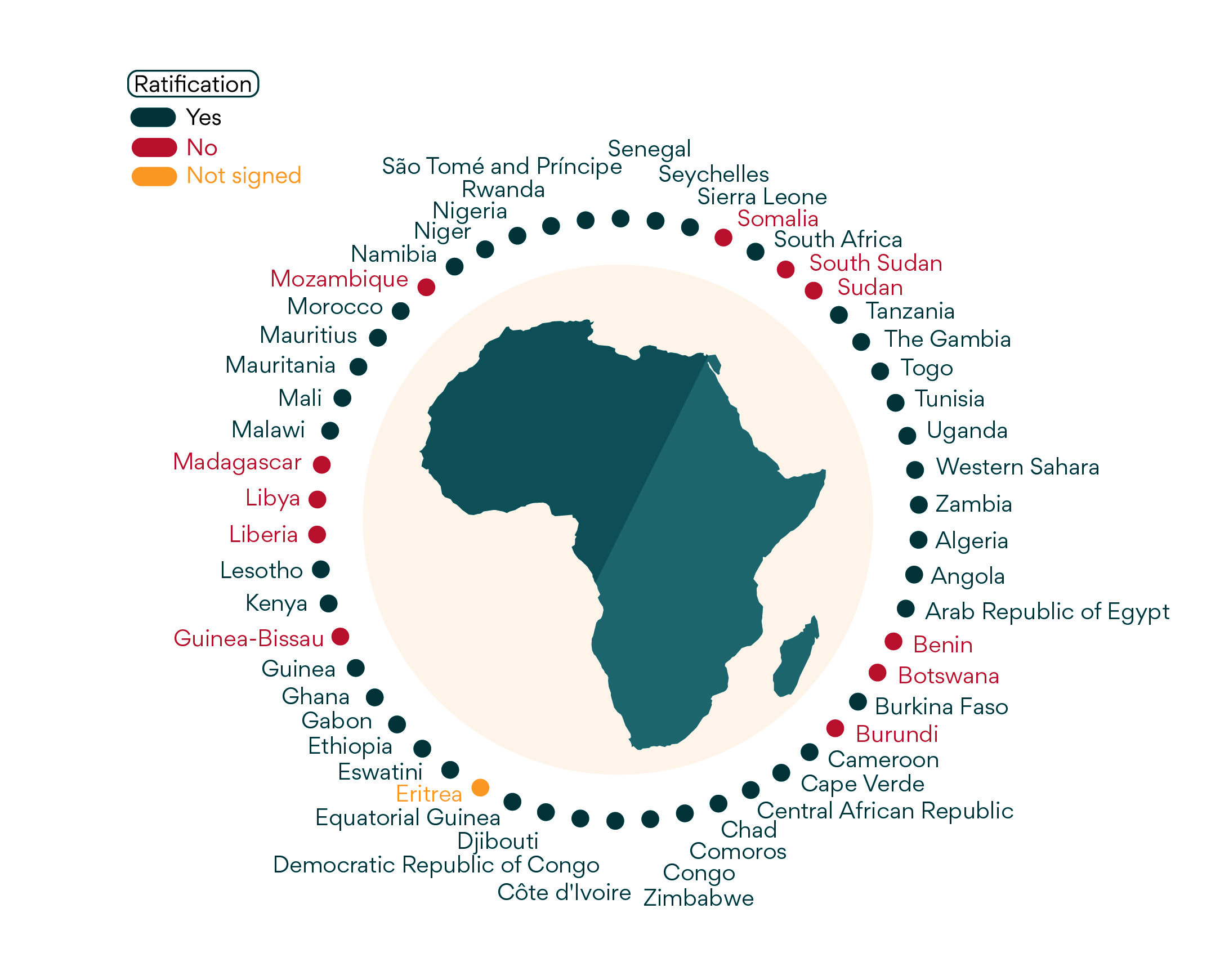

By December 2022, 44 of the 54 signatories (81.5%) have deposited their instruments of AfCFTA ratification [5] .

In October 2022, the AfCFTA Guided Trade Initiative was launched which pilots AfCFTA preferential trade among eight member states (Cameroon, Egypt, Ghana, Kenya, Mauritius, Rwanda, Tanzania and Tunisia) for 96 identified commodities, including ceramic tiles, tea, coffee, processed meat products, corn starch, sugar, pasta, glucose syrup, dried fruits, and sisal fibre, amongst others, in line with the AfCFTA focus on value chain development. The first shipments under the Guided Trade Initiative to benefit from AfCFTA Certificate of Origin included Rwanda's instant coffee and Kenya's batteries destined to Ghana [6] .

A.5. Who are the Members of the AfCFTA?

State Parties and Member States are terms used in the AfCFTA Agreement. The "Member States" are the AU's member countries. The AU Member States that have approved or joined the AfCFTA Agreement and for which it is in effect are referred to as "State Parties." Under the AfCFTA Agreement, only the State Parties will have rights and obligations. The ongoing negotiations involve both State Parties and Non-State Parties. Member States of the AU that have not ratified the AfCFTA are referred to as non-state parties.

As of December 2022, except for Eritrea, 54 out of the 55 AU Member States, have signed the consolidated text of the Agreement Establishing the AfCFTA [7] .

A.6. What do the AfCFTA legal instruments cover ?

The AfCFTA Agreement is the treaty establishing the African Continental Free Trade Are and providing for Protocols on Trade in Goods, Trade in Services, Investment, Intellectual Property Rights, and Competition Policy.

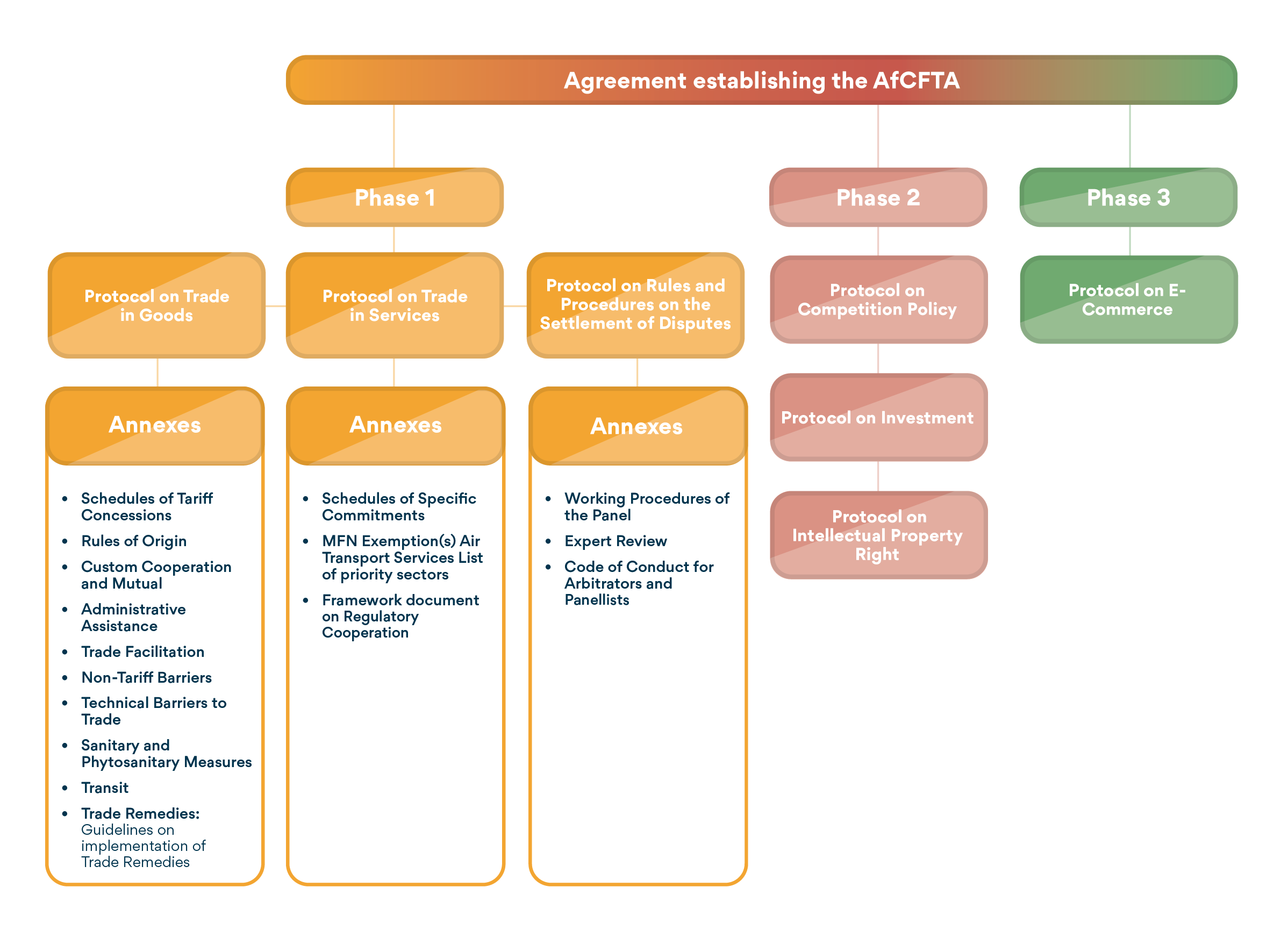

The AfCFTA negotiations take place in phases. Trade in goods and services as well as dispute resolution are both included in Phase I. Phase II deals with investment, competition policy, and intellectual property rights. E-commerce will be addressed in Phase III, which has been added.

On May 30, 2019, the AfCFTA Agreement, Protocol on Trade in Goods and Services, and Protocol on Rules and Procedures for the Settlement of Disputes (together with their annexes and appendices) became legally binding. The five key service sectors (business services, communications, finance, tourism, and transport) are currently the subject of ongoing discussions to finalize the schedules of particular commitments. The negotiations were expected to be concluded by June 2021.

Trade under AfCFTA rules can only happen once all the legal arrangements are in place, but the AU Summit decided in December 2020 to allow trade under the reciprocal offers already extended as part of the Phase I negotiations. This has not happened, and at the 35th Ordinary Session of the Assembly of the AU (5-6 February 2022), Heads of State and Government decided that "commercially meaningful trade” should begin at a date to be determined.

The AfCFTA goes beyond traditional trade agreements that merely reduce tariffs. It also liberalizes services trade. This is crucial: services constitute roughly 60 per cent of Africa's GDP and in 2014, for example, services accounted for 30 per cent of world trade. Services are also inputs to production processes that in turn enable trade in goods. In the AfCFTA, African countries have committed to progressive services liberalization in which domestic services markets are to be opened for service suppliers from other African countries.

Beyond tariffs, non-tariff barriers, such as burdensome customs procedures and excessive paperwork, are often a greater impediment to businesses than tariffs. The AfCFTA is to include a "non-tariff barrier mechanism” for reporting and resolving such barriers on trade between African countries, helping businesses to demand solutions to their trading barriers.

Similarly, the AfCFTA also includes provisions for the recognition of technical and sanitary standards, transit facilitation and customs cooperation. By doing so, the aim is to significantly ease doing business across borders in Africa.

A.7. What is expected of the AfCFTA?

As the largest trade pact among African countries, the AfCFTA is expected to :

- Eliminate trade barriers between members, making it easier for businesses to trade within Africa and benefit from their own growing market;

- Introduce regulatory measures such as sanitary standards and eliminating non-tariff barriers to trade;

- Establish a liberalized market for goods and services;

- Facilitate capital flow;

- Facilitate investments by creating a sizable market;

- Catalyze the introduction of new technology to boost productivity;

- Increase the competitiveness of members' economies;

- Promote industrial development through diversification; and

- Develop value-added systems for products.

- Establish, in the future, a Common Continental Market.

A.8. How will the AfCFTA's dispute resolution process operate and who can file claims?

The AfCFTA has a dispute settlement system modelled on the Dispute Settlement Understanding of the WTO. It consists of Panels and an Appellate body. Under the AfCFTA, dispute settlement is only available to State Parties.

Private parties (exporters, importers, service providers, etc.) are not eligible to use the AfCFTA dispute resolution mechanism on their own. Private parties will only be safeguarded if a State Party files a claim and is able to demonstrate that its rights have been breached.

For a conflict to be resolved, the parties must first consult with one another. They are always free to utilize their goodwill, engage in confidential conciliation, or engage in mediation. Arbitration is another option open to disputing parties.

It is recommended that the State Party in question bring the measure into compliance with its duties when a Panel or the Appellate Body finds that a measure is in conflict with the AfCFTA legislative instruments. The Panel or the Appellate Body may also make suggestions for how the concerned State Party might carry out the recommendations [8] .

A.9. What difficulties does the AfCFTA's implementation face?

AFCFTA implementation may face a number of difficulties. Despite their significant differences in size, degrees of economic growth, and economic diversification, and despite the difficulty of guaranteeing widespread benefits for all member states, the agreement will imply harmonizing Africa's heterogeneous economies.

The AfCFTA is the continental free trade agreement with the highest levels of income inequality. Many nations, particularly the 32 least developed nations, struggle to diversify their economies, create new jobs, and expand their industrial sectors.

Conflicts, inadequate infrastructure, and slow technological adoption will pose threats to the agreement's implementation in some nations. Segments of the population have also spoken of a generalized fear of losing identity and control.

A.10. What are the operational instruments of the AfCFTA?

During the launch of the operational phase of the AfCFTA in Niamey in July 2019, five operational instruments were unveiled:

- The Rules of Origin : A regime governing the conditions under which a product or service can be traded duty free across the region;

- The Tariff concessions : It has been agreed that there should be 90% tariff liberalisation and the deadline is 1st July 2020. Over a 10 year period with a 5 year transition, there will be an additional 7 % for "sensitive products" that must be liberalized;

- The online mechanism on monitoring, reporting and elimination of non-tariff barriers , NTBs: NTBs are a great hindrance to intra-African trade whether physical, like poor infrastructure, or administrative like the behaviour of customs officials. These are to be monitored with a view to ensuring they are eliminated.

- The Pan-African payment and settlement system : To facilitate payments on time and in full, by ensuring that payments are made in local currency and at the end of the year there'll be net settlements in foreign exchange. With the certainty of payments, there will be confidence in the system.

- The African Trade Observatory : A trade information portal to address hindrances to trade in Africa due to lack of information about opportunities, trade statistics as well as information about exporters and importers in countries. The trade observatory will have all this information and other relevant data which will be provided by AU member states.

B. Top 9 questions from MSMES

B.1. What advantages does the AfCFTA offer African MSMEs?

African MSMEs are recognized as a significant objective for the AfCFTA because they can profit from improved access to new markets and the potential economic transformation that competition in these areas could foster.

The agreement provides several advantages to African MSMEs, which are crucial given their significance to the continent's economy as up to 80% of firms and up to 40% of national GDP.

These advantages include :

- fostering specialization and accelerating industrialization;

- expanding employment and investment opportunities;

- advancing technological development;

- enabling African-owned businesses to enter new markets, broaden their clientele, and develop new goods and services;

- bridging the manufacturing gap;

- providing more opportunities for MSMEs to generate more well-paying jobs, particularly for young people;

- boosting investments that provide cash to indigenous companies; streamlining the process of importing raw materials from other African nations;

- and allowing MSMEs to establish assembly companies in other African nations to provide more affordable production methods.

B.2. What are some challenges that African MSMEs may face?

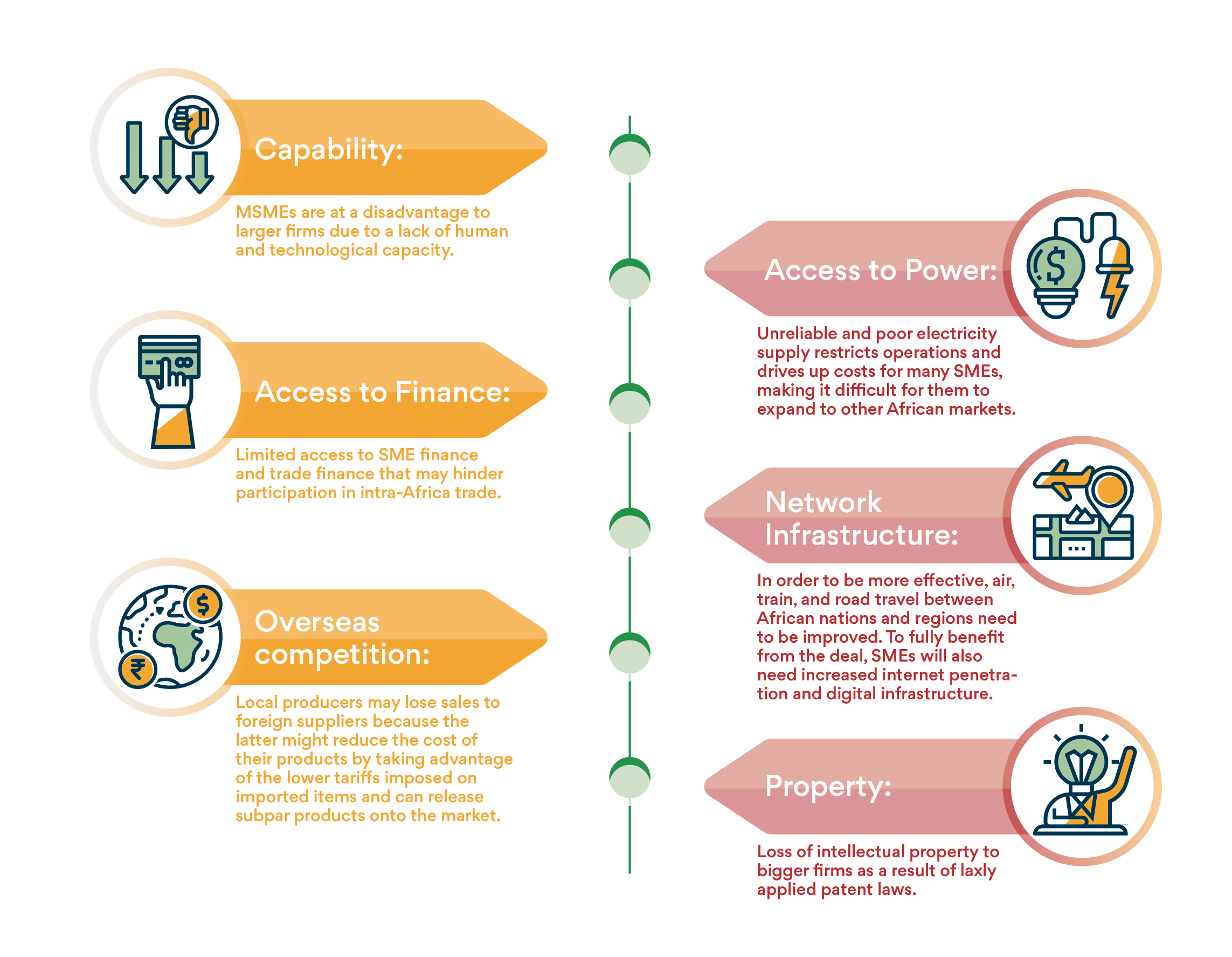

Despite all of its advantages, the accord may yet run into some problems within Africa. These consist of :

- Capability: MSMEs are at a disadvantage to larger firms due to a lack of human and technological capacity.

- Access to Power: Unreliable and poor electricity supply restricts operations and drives up costs for many SMEs, making it difficult for them to expand to other African markets.

- Access to Finance: Limited access to SME finance and trade finance that may hinder participation in intra-Africa trade.

- Network Infrastructure: In order to be more effective, air, train, and road travel between African nations and regions need to be improved. To fully benefit from the deal, SMEs will also need increased internet penetration and digital infrastructure.

- Overseas competition: Local producers may lose sales to foreign suppliers because the latter might reduce the cost of their products by taking advantage of the lower tariffs imposed on imported items and can release subpar products onto the market.

- Loss of intellectual property to bigger firms as a result of laxly applied patent laws.

B.3. What is the role of AfCFTA rules of origin?

In the context of international trade, Rules of Origin (RoO) are legal regulations that are used to identify the nationality of a commodity. Non-preferential and preferential RoO can be separated out: Preferential RoO are the rules outlined in agreements of preferential trade areas between two or more countries (such as those forming part of the AfCFTA), and they specify the minimum amount of processing and other criteria that must be met in order to qualify for preferential treatment. Whereas, non-preferential RoO are national laws used to assign origin to traded goods for purposes such as trade statistics, trade remedies, labeling requirements, and various other purposes.

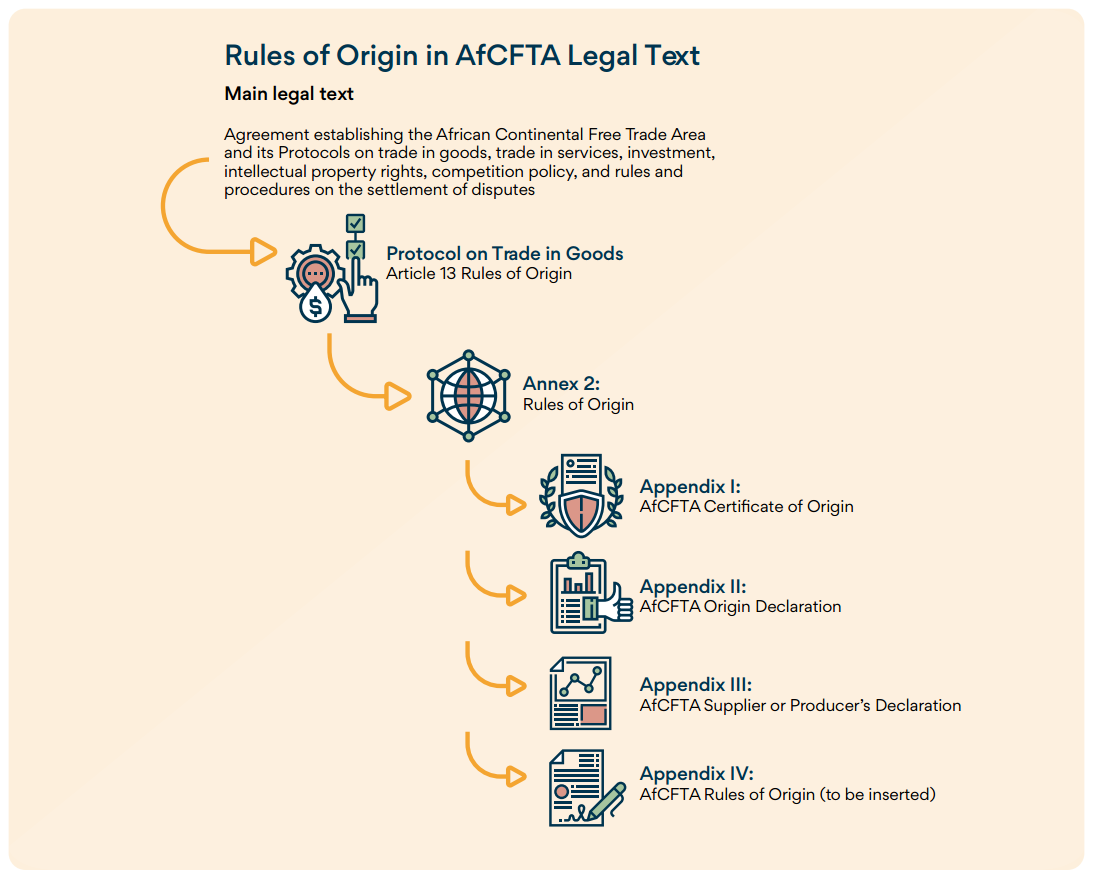

The AfCFTA RoO are included as Annex II2 to the AfCFTA agreement (Annex I covers the import tariff concessions).

Sections I, II and III of Annex 2II contain the general provisions, including provisions such as the criteria for ' wholly obtained', cumulation , origin declarations , simple/ insufficient processing , key definitions, and others. The RoO Annex also contains a number of Appendixes:

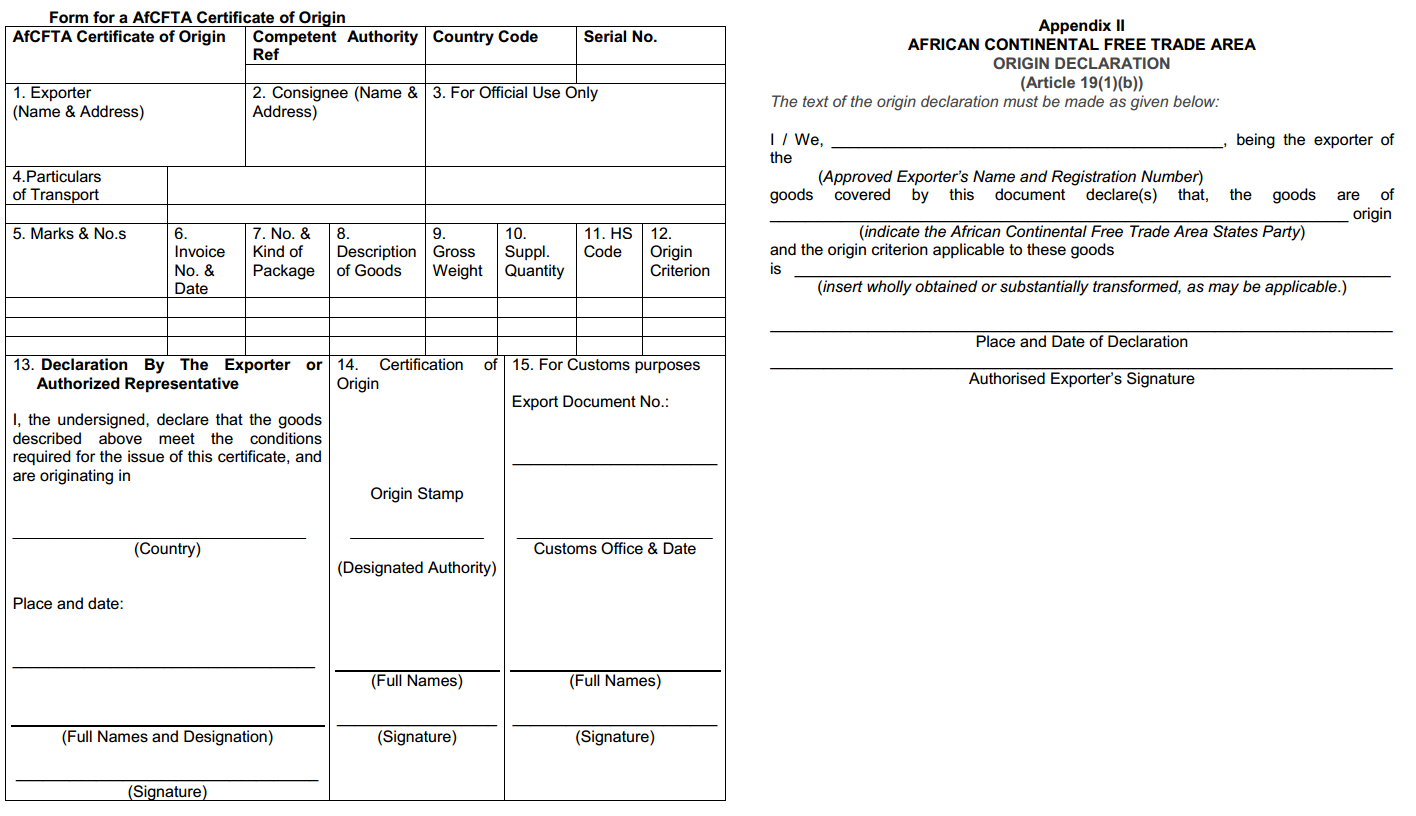

- Appendix I: A sample copy of the Certificate of Origin

- Appendix II: The text of the self-issued origin declaration (for shipments by approved exporters or within USD 5,000)

- Appendix III: A sample AfCFTA supplier or producer's declaration (to cover regional inputs)

- Appendix IV: The AfCFTA product-specific RoO criteria

The AfCFTA RoO are essentially being discussed sector by sector, leading to origin regulations that are specific to particular products (rather than generic origin criteria that apply equally to all products). The benefit of this is that appropriate criteria that better account for the unique dynamics of each sector can be created; nevertheless, this procedure also makes discussions more difficult and time-consuming. However, the general RoO provisions contained in the main RoO Protocol (Annex II) shall apply equally to all products.

B.4. How will a trader determine the origin status of a product?

If a product claims origin status in order to receive preferential market access under the AfCFTA, it must first be demonstrated that any non-originating inputs have undergone significant local transformation. The AfCFTA RoO must be consulted by the exporter or producer in this case. These regulations provide particular standards that, for each product, define "substantial transformation," and they may be founded on one or more of the three approaches described below.

- Regional value content: To identify origin status, this methodology uses percentage thresholds as the criterion. Where applicable, the AfCFTA RoO established an upper limit based on a percentage for the quantity of imported materials that may be used.

- Change in tariff classification: Products that incorporate any non-original materials must undergo local processing that results in a new HS classification.

- Specific processing: This approach, also known as the "technical" test, is often employed in the AfCFTA and establishes product-specific processing requirements that must be completed in order to qualify for origin designation.

Key steps to determine if the product meets AfCFTA RoO:

- What is the export destination? If it is part of the same REC, then those RoO or AfCFTA RoO can apply as before depending on preferential tariff conditions.

- Defining the precise HS code for the product

- Look up the product-specific RoO (Appendix IV)

- Look up the basic RoO guidelines (Section II of Annex II)

- Is the product exclusively created with local materials?

- Has the source of inputs come from another AfCFTA Member State?

- Does the local processing exceed "insufficient operations"?

B.5. How can a trader determine which tariff rate is applied under the AfCFTA?

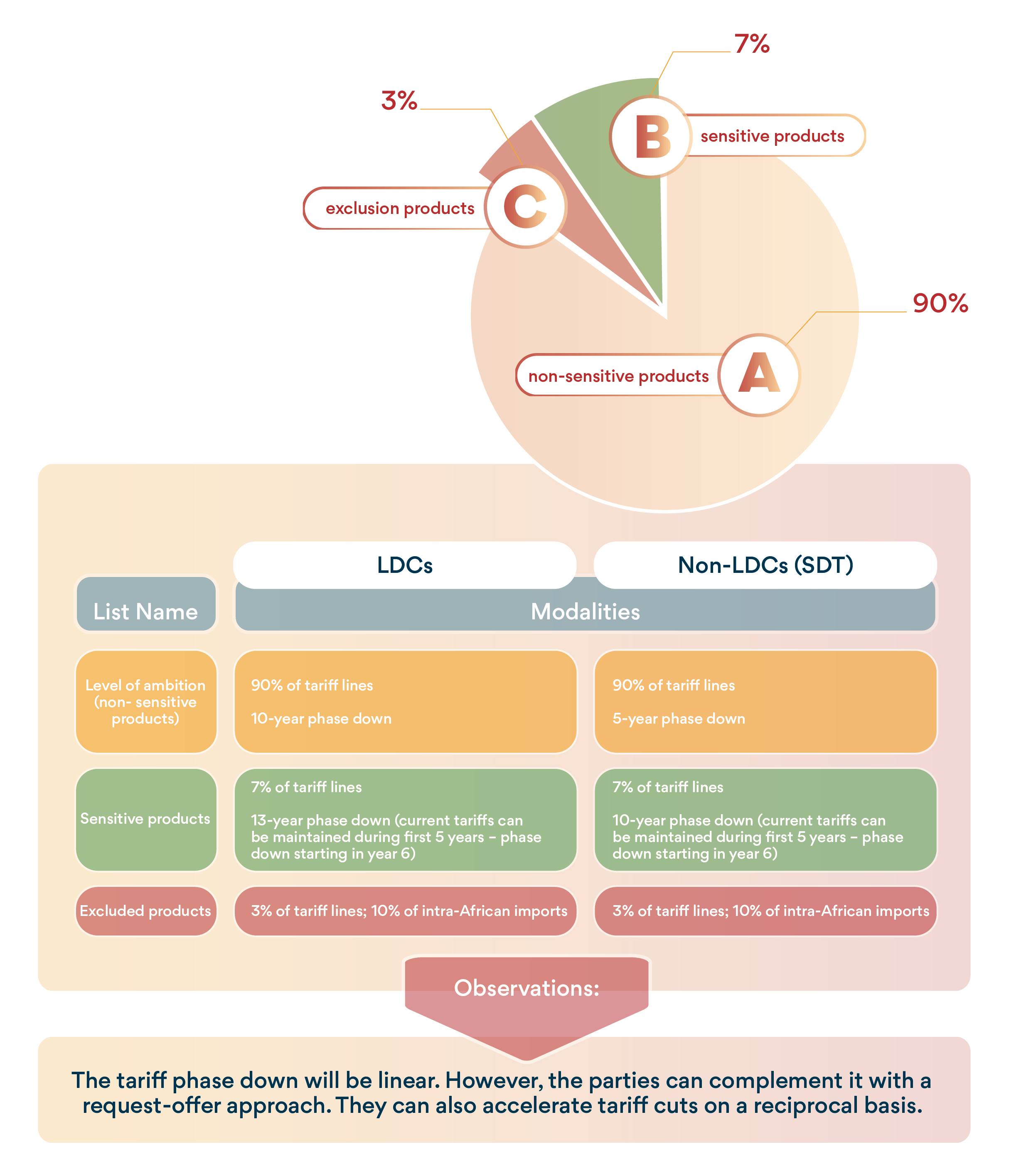

Tariff liberalization under the AfCFTA takes place in line with the AfCFTA Tariff Modalities. Each country or customs union (ECOWAS, CEMAC, SACU, EAC) designates a schedule of tariff concessions which includes: At least 90% of products are non-sensitive (category A) and the base rate, which is the most-favoured nation (MFN) tariff applied as of May 2019, is dismantled within 5 years (for LDCs 10 years); 7% of products are sensitive (category B) and the base rate is dismantled within 10 years with a flexibility of a transitional period of 5 years (for LDCs 13 years); no more than 3% of products are Exclusion List (category C) and no tariff reduction is applied. Excluded products in addition shall not exceed 10% of total import value from other State Parties. This clause is known as "double qualification and anti-concentration” clause. The recommended time range for assessment of import value is 2015-2017, or 2014-2016.

Countries and customs union groups are independent in selecting Sensitive and Exclusion Lists while being guided by the following criteria: food security, national security, fiscal revenue, livelihood and industrialization. As part of tariff negotiations, countries can feedback on each other's tariff offers on a counter-proposal basis trying to improve the ambition of the Lists, while remaining in compliance with the technical modalities. Due to a large number of pairs of negotiating countries involved and a massive amount of data required, an AfCFTA Online Tariff Negotiation Tool was developed and launched in June 2020.

The Thirteenth Extraordinary Session of the African Union Assembly of Heads of State and Government held in Johannesburg in December 2020, decided that the start of trade under the African Continental Free Trade Area (AfCFTA) shall officially commence on 1 January 2021 on the basis of legally implementable and reciprocal schedules of tariffs concessions.

The 7th Meeting of the AfCFTA Council of Ministers responsible for Trade, on 10th October 2021, adopted the Ministerial Directive on the Application of Provisional Schedules of Tariffs Concessions. This Ministerial Directive provided a legal basis for the countries that had submitted their tariff schedules in accordance with the agreed modalities to trade preferentially amongst themselves.

The Provisional Schedules of Tariffs Concessions can be accessed and searched at the product code level at the AfCFTA e-Tariff Book . Please note that between 30 and 40 countries have submitted their provisional tariff offers, and some have not yet designated their Sensitive and Exclusion lists.

B.6. How can a trader navigate the technical language of rules of origin in the AfCFTA?

To access the uniform guidelines on operationalization and application of AfCFTA rules of origin a user can download the AfCFTA Rules of Origin Manual. The Manual spells out in detail the application of the rules used in determining the origin status of Goods, procedures of administering the rules and the institutional framework for the implementation of the AFCFTA Rules of Origin. The Manual complements the guidelines with numerous examples and illustrations.

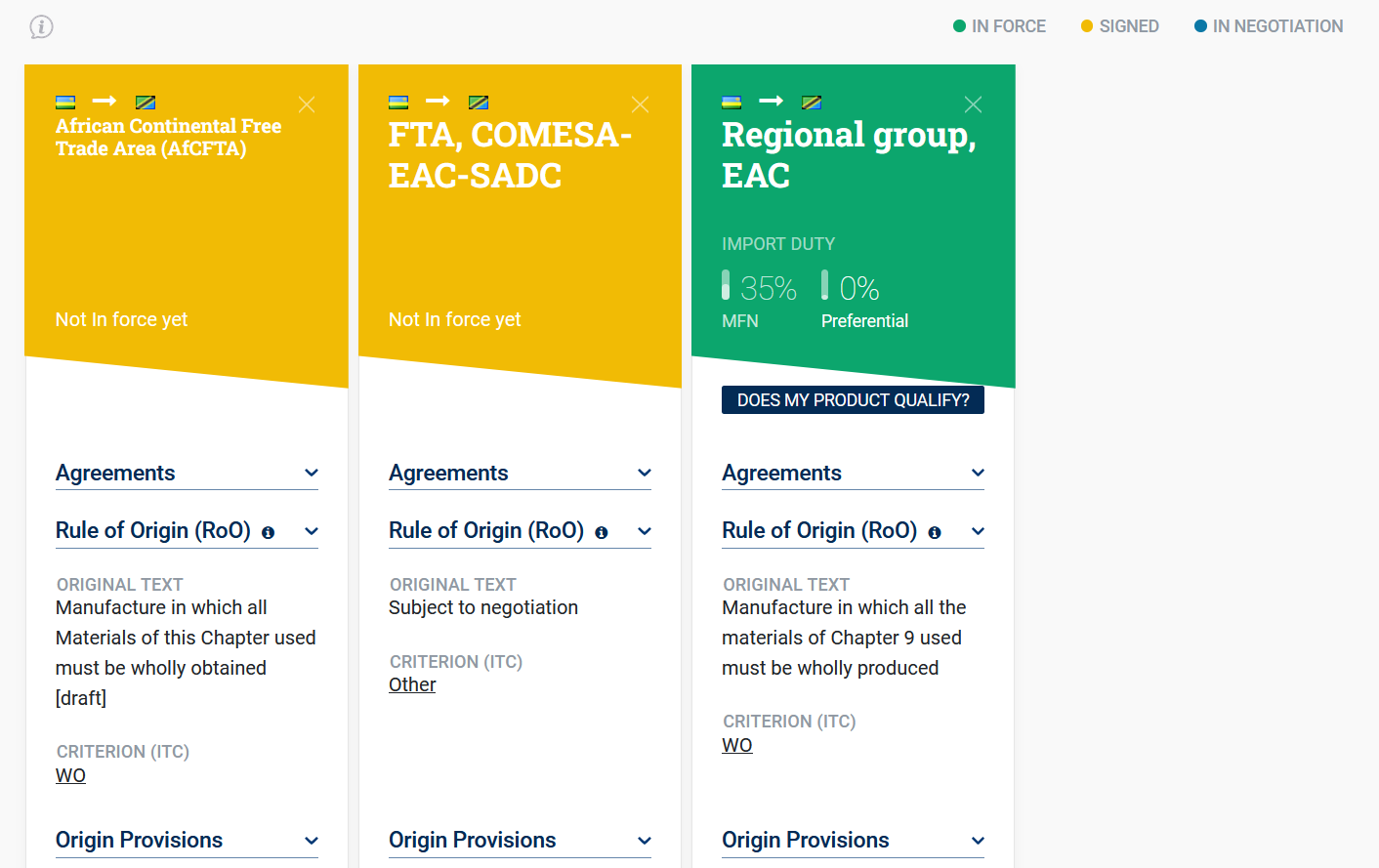

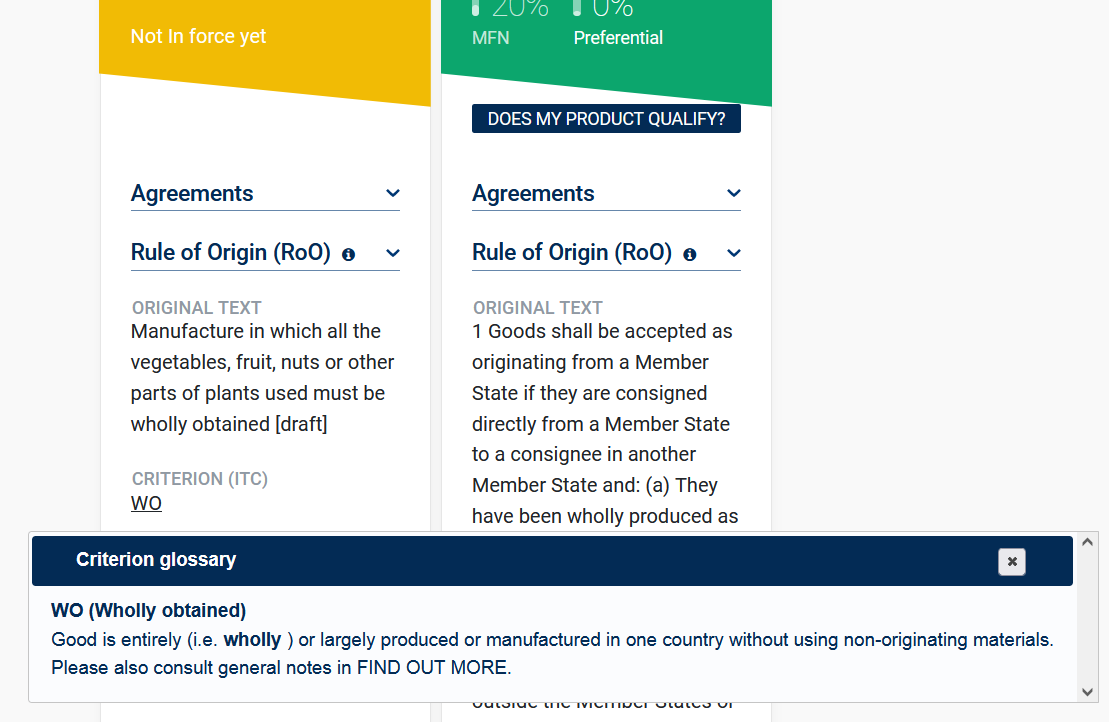

Draft AfCFTA rules of origin have been integrated into ITC-WCO-WTO Rules of Origin Facilitator (https://findrulesoforigin.org/) and can be browsed and compared along with other existing preferential trade arrangements among African countries.

The joint tool helps to search and compare rules of origin and key provisions in a systematic and simplified manner, for most trade agreements in the world, supplemented with glossaries and annotations.

B.7. If the dispute settlement system is not designated for the private sector, do private parties have any legal options?

Despite not being in the same position as State Parties, private parties' actions are crucial to the AfCFTA's success. A different category of trade remedies that can be used to stop unfair trade practices like the dumping of goods or the subsidizing of imports may be advantageous to them. Additionally, they might receive (temporary) protection when there is a rise in imports due to trade liberalization taking place as a result of the AfCFTA. These remedies entail an alternative process wherein affected private parties may ask national investigative authorities to carry out the required investigations and impose anti-dumping duties, countervailing measures, or safeguard measures. Trade remedies, including safeguards, are specifically covered in the AfCFTA Annex. Under the laws of the host governments, private parties like service providers and investors will have some rights to due process. Following the Investment Protocol's adoption, it will be clear how and where private investors' rights would be protected.

B.8. How to practically use AfCFTA in one example?

Consider the following example as a case study. A grape juice producer based in Tunisia seeks to benefit from AfCFTA and export to Madagascar. The ingredients used to make one bottle of juice (classified by HS code 200969) include local fresh grapes, imported granulated sugar and sodium citrate (E331), and local water, as show in the bill of materials below:

| Ingredients | HS Code | Origin | Value/Bottle (CIF) |

|---|---|---|---|

| Fresh grapes | 0806 | Tunisia | $0.9 |

| Granulated sugar | 1701 | China | $0.2 |

| Sodium Citrate (E331) | 2918 | France | $0.1 |

| Water | 2201 | Tunisia | $0.05 |

By navigating the available online tools, such as ITC-WCO-WTO Rules of Origin Facilitator, AfCFTA e-Tariff Book and AfCFTA Manual on Rules of Origin, as well as national platforms such as Tunisia's Regional Trade Agreements with Africa. (https://www.africatradeagreements.tn) , the exporter will be able to answer each of the following question

- Which agreements are in force and which are signed between Tunisia and Madagascar?

- What is the AfCFTA origin criterion applicable to the product? Does the product meet the criterion?

- Determine if the product is still considered AfCFTA originating if the producer uses grapes imported from Chile instead of local grapes? From South Africa instead of local grapes?

- Which AfCFTA proof of origin is required if the producer is not an approved exporter?

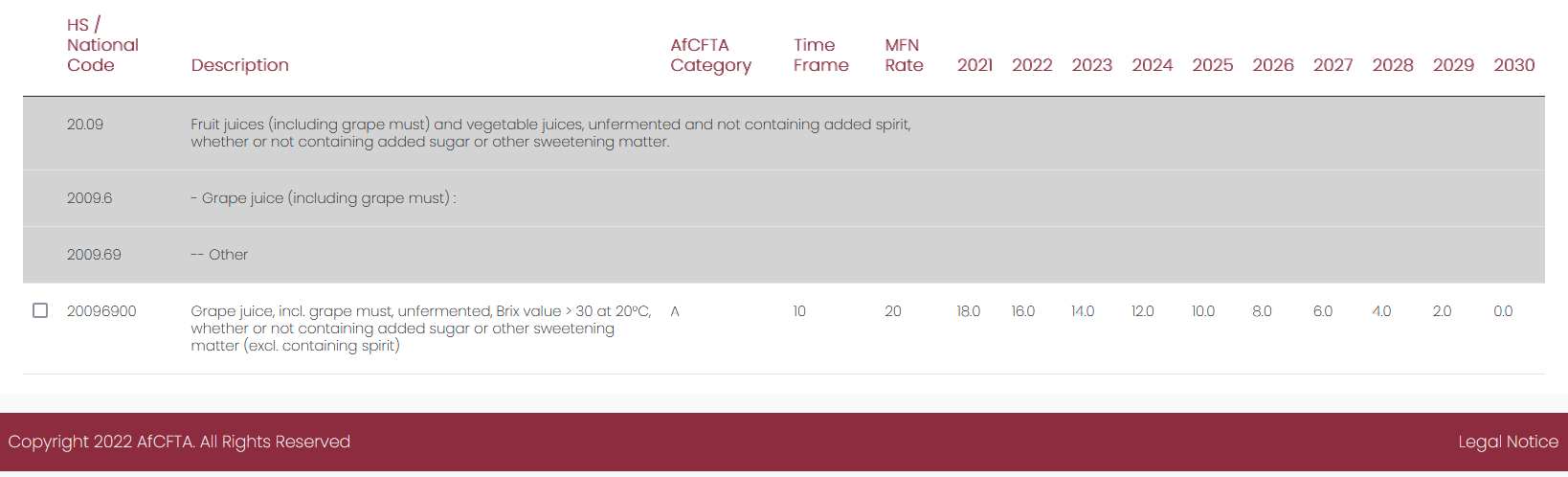

- What is the MFN tariff rate that Madagascar currently applies to this product and the AfCFTA tariff rate that Madagascar applies to this product in 2023. When will tariff on this product be eliminated entirely by Madagascar?

- If the process of compliance with rules of origin increases the cost of exportation by 5%, given the AfCFTA tariff rate in 2023, should the exporter attempt to use preferences?

- How would the answers change for grape wine (22042100) instead of grape juice for Madagascar market?

Proposed answers are provided below.

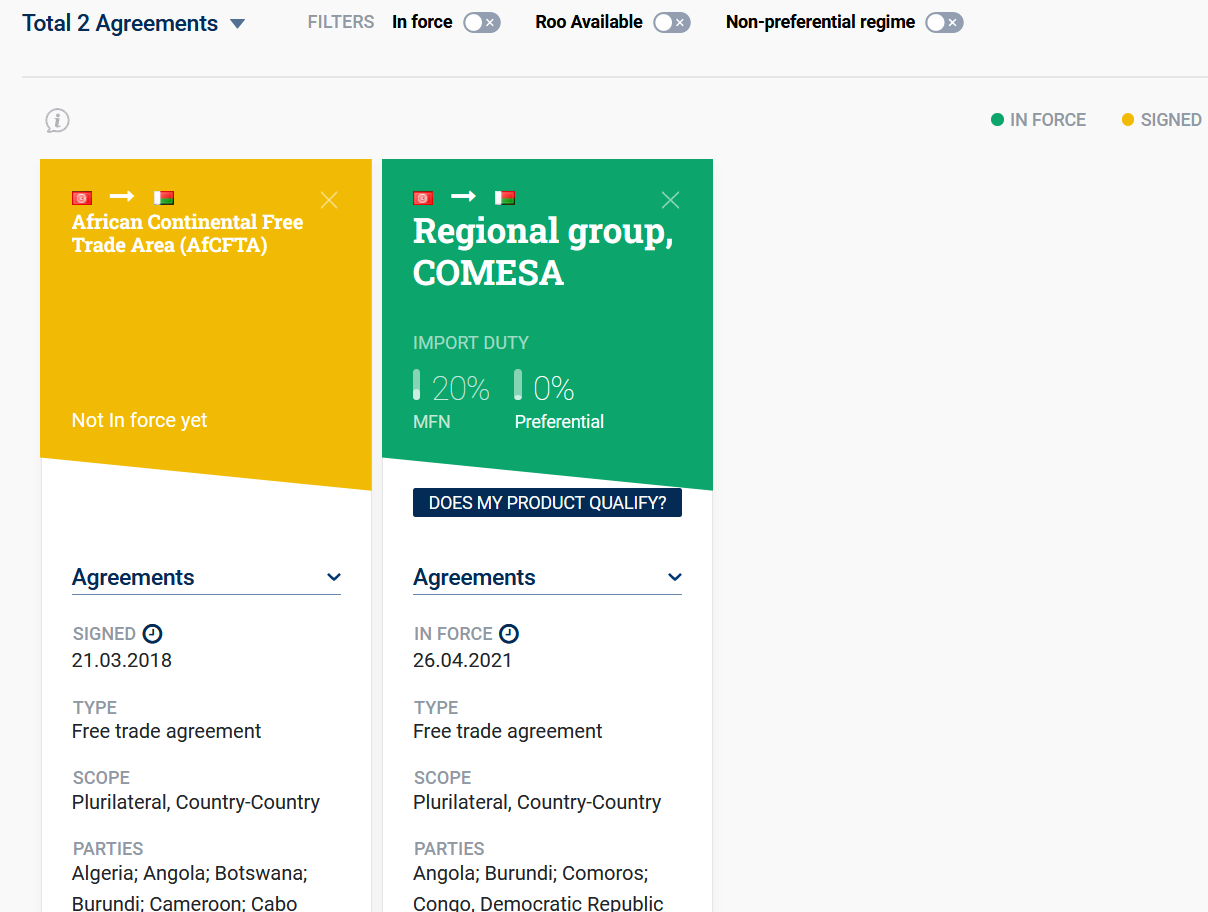

Which agreements are in force and which are signed between Tunisia and Madagascar?

Using the Facilitator, by entering the exporting country as Tunisia, the importing country as Madagascar, and the national tariff line code of the product being 20096900, we instantly identify agreements and applied tariff conditions.

The only agreement that currently applies for juice is COMESA. AfCFTA is signed but not yet in force (operational) between the two countries. AfCFTA Guided Trade Initiative applies for Tunisia, but not Madagascar.

What is the AfCFTA origin criterion applicable to the product? Does the product meet the criterion?

Scrolling down the search results in the Facilitator, we identify the following origin criterion: "Manufacture in which all the vegetables, fruit, nuts or other parts of plants used must be wholly obtained [draft].” The codified criterion is WO (Wholly Obtained) for used local fruits. Of all materials used, only fresh grapes can be considered as fruits or other parts of plants. The grapes are wholly obtained, as they were grown and harvested in Tunisia, therefore, the condition is satisfied; therefore, the juice is considered originating.

Determine if the product is still considered AfCFTA originating if the producer uses grapes imported from Chile instead of local grapes? From South Africa instead of local grapes?

If the producer uses grapes imported from Chile instead of local grapes, the condition (materials derived from grapes used must be wholly obtained) is not fulfilled and thus the juice shall lose it originating status.

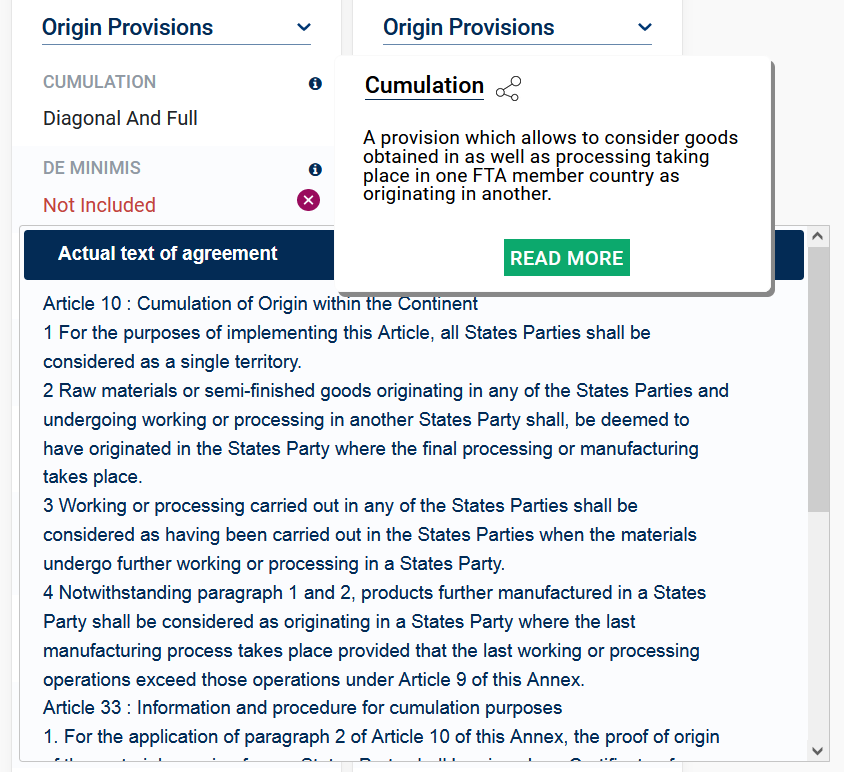

In the case of South African grapes, according to Paragraph 2 of Article 10 of Annex 2 of the AfCFTA on Cumulation of Origin, grapes grown and imported from South Africa used for making juice in Tunisia will be considered as having origin in Tunisia. Therefore, the juice is still considered originating .

Which AfCFTA proof of origin is required if the producer is not an approved exporter?

A Certificate of Origin (COO) issued by a Designated Competent Authority is required, per Paragraph 1 of Article 19 on Proof of Origin, unless the shipment value is less than USD 5,000 in which case a self-issued origin declaration is sufficient per Article 21.

What is the MFN tariff rate that Madagascar currently applies to this product and the AfCFTA tariff rate that Madagascar applies to this product in 2023. When will tariff on this product be eliminated entirely by Madagascar?

MFN tariff of Madagascar is 20%. Facilitator displays MFN rate 20% but not the AfCFTA rate from Madagascar's tariff offer. By 2023, the preferential tariff applied by Madagascar to grape juice imported from AfCFTA countries is 14% per AfCFTA e-Tariff Book (https://etariff.au-afcfta.org/advancesearch). AfCFTA tariff will be eliminated entirely by 2030.

If the process of compliance with rules of origin increases the cost of exportation by 5%, given the AfCFTA tariff rate in 2023, should the exporter attempt to use preferences?

Drawing on the previous answer, supposing that the MFN rate remains unchanged (20%), the tariff saving is 6%. If complying with rules of origin increases the cost of exportation by 5%, the profit margin from duty savings is still positive (1%), and therefore, it is advised that the exporter uses the preferences offered by the agreement.

How would the answers change for grape wine (22042100) instead of grape juice for Madagascar market?

AfCFTA origin criterion for wine states: “Manufacture from Materials of any Heading except that of the Product and in which any grapes and other Materials derived from grapes used must be wholly obtained.” In coded version it is CTH + WO. For CTH, of all materials used, only sugar (HS 1701) and E331 (HS 2815) are not originating. However, these materials have undergone a change in tariff heading as they belong to different HS heading as compared to the final product (wine).

MFN rate is 20%, same as for grape juice. Using the e-Tariff Book (https://etariff.au-afcfta.org/) to find the tariff offers we insert as the importing country Madagascar. Madagascar maintains its 20% MFN rate under Category C (‘Exclusion list') and will not provide a AfCFTA preferential rate. AfCFTA should not be used because there are no duty savings.

B.9. How to practically compare AfCFTA with RECs in one example?

Continuing the previous example of Tunisia's wine exported to Madagascar, we compare AfCFTA benefits with COMESA. We answer the following questions:

- Does COMESA offer better tariff conditions than AfCFTA?

- Does the wine also pass the rule of origin under COMESA?

- Which rules of origin offer more flexibility: AfCFTA or COMESA?

- Which formulation of the origin criterion from the above would be the easiest to understand and apply for a wine producer without technical skills in trade and customs?

We propose an answer to each question below.

Does COMESA offer better tariff conditions than AfCFTA?

Under COMESA, Madagascar offers preferential tariff of 0% while for AfCFTA, wine appears on Exclusion List (‘C'). Therefore, COMESA offers better tariff conditions in this example.

Does the wine also pass the rule of origin under COMESA?

COMESA offers 4 alternative origin criteria: (i) WO (ii) RVC 40% (build-down method) (iii) RVC 35% (build-up method) and (iv) CTH + ECT.

(i) WO is not passed because the wine uses foreign inputs (sugar, E331);

(ii) RVC 40% is passed because per formulation, CIF cost of foreign inputs ($0.1+$0.2=$0.3) does not exceed 60% of CIF cost of all inputs ($1.25);

(iii) RVC 35%: not enough information due to missing Ex-factory cost of wine (price out of the factory gate). However, assuming that winemaker does not sell at a loss, per definition of “value added” in Rule 1, it will be at least ($1.25-$0.3$)/$1.25=76%. Thus the rule is likely passed.

(iv) The rule is almost identical to AfCFTA, with an additional restriction not to use foreign juice (HS 2009) and vermouth and other types of wines (HS 2205). Therefore, it passes.

Thus exporter definitely passes (ii) and (iv), and likely passes (iii). For compliance purposes, exporter only needs to pick one of the three alternative rules to declare on the certificate of origin.

Which rules of origin offer more flexibility: AfCFTA or COMESA?

COMESA is more flexible in origin criteria because it offers 2 RVC rules as alternative options, and exporter definitely passes one of them, and likely another one.

On the other hand, AfCFTA offers flexibility in cumulation of inputs. For example, South Africa is not a COMESA party and so its local grapes would not be allowed for cumulation under COMESA.

Which formulation of the origin criterion from the above would be the easiest to understand and apply for a wine producer without technical skills in trade and customs?

We assume that the juice and wine producer would lack confidence in technical knowledge of Incoterms and manufacturing accounting (for RVC criteria) and HS nomenclature (for change in tariff heading rule with further HS exceptions). Thus the part of AfCFTA rule requiring grapes to be wholly obtained would seem the clearest.

C. Top 6 questions from trade officials

C.1. What is the status of current Regional Economic Communities (RECs) and other regional commercial agreements in Africa?

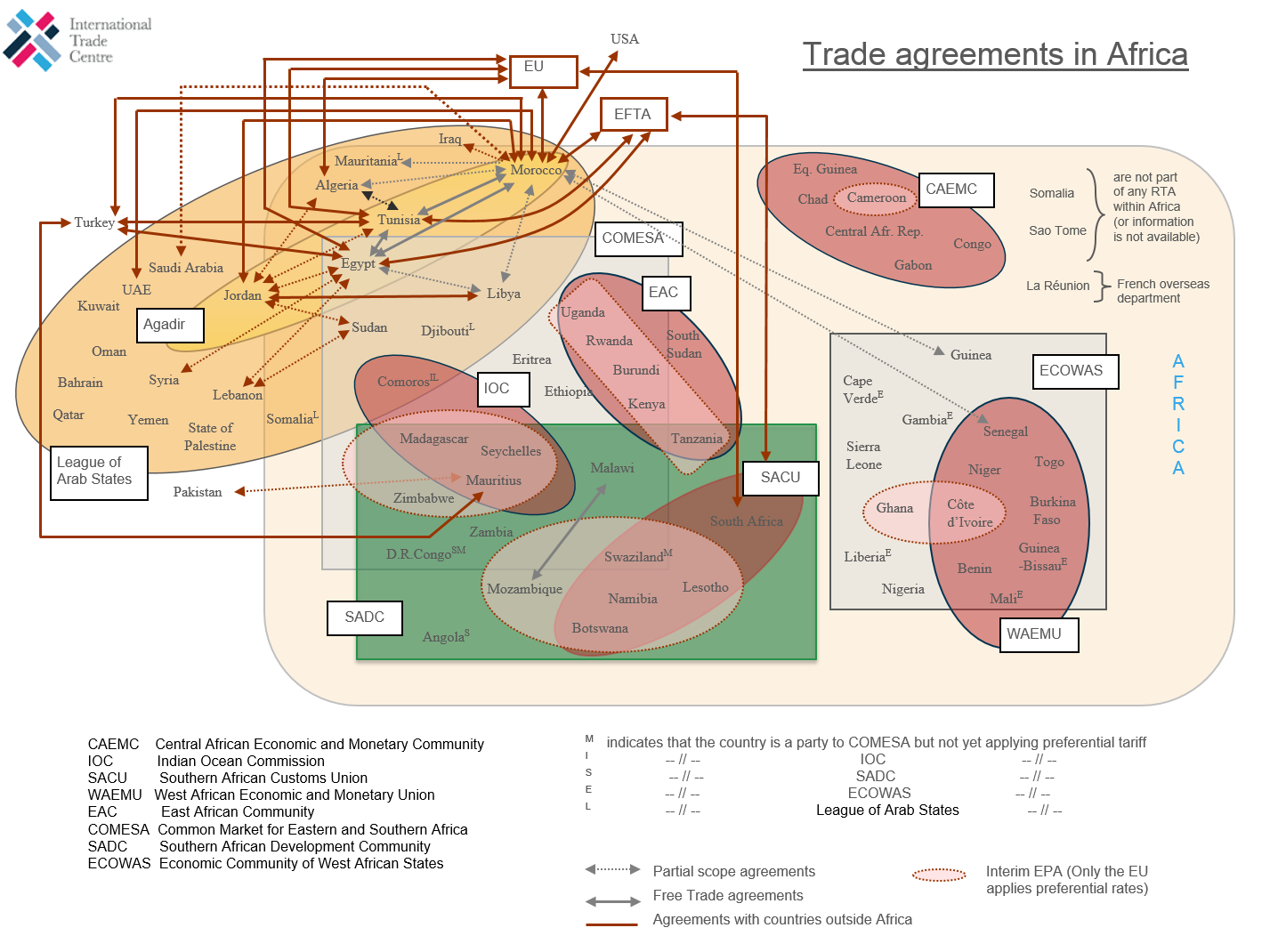

The AU recognizes eight RECs , including the Arab Maghreb Union (AMU), the Common Market for Eastern and Southern Africa (COMESA), the Community of Sahel-Saharan States (CEN-SAD), the East African Community (EAC), the Economic Community of Central African States (ECCAS), the Economic Community of West African States (ECOWAS), the Intergovernmental Authority on Development (IGAD), and the Southern African Development Community (SADC).

"State Parties that are members of other regional economic communities, regional trading arrangements, and custom unions, which have achieved higher levels of regional integration among themselves than under this Agreement, shall maintain such higher levels among themselves," reads Article 19(2) of the AfCFTA Agreement.

This means that the RECs are regarded as the AfCFTA's foundational elements. Therefore, the Tripartite Free Trade Area (TFTA), once it is in effect, the recognized RECs, as well as customs unions like the Southern African Customs Union (SACU) and those proposed in some of the RECS, shall be preserved [9] .

C.2. Which rules of origin apply - REC or AfCFTA?

Since the AfCFTA does not replace or abolish existing RECs, it recognizes their existence and continued operation. It means the pre-existing tariff regimes, associated regional RoO clauses, and related preferences will continue to be in effect for all trade between parties to such an agreement. As a result, the AfCFTA introduces a preferential trade system for trade between nations that was previously conducted on a conventional MFN basis, or without the availability of any special advantages.

- Trade within existing RECs (e.g., SADC, COMESA, ECOWAS, ECCAS): established RoO and tariffs of these RECs will continue to apply to intra-regional trade, along with AfCFTA.

- Trade between countries not in an established REC relationship (e.g., South Africa-Kenya; Ghana-Ethiopia etc.): New AfCFTA RoO and tariffs apply, as negotiated (in tariff lines and RoO, where agreed and implemented)

C.3. Are AfCFTA State Parties permitted to engage in free trade negotiations with other parties?

A State that is not a party to the AfCFTA Agreement is referred to as a third party (Art. 1 of the AfCFTA Agreement). Nothing in the AfCFTA Protocol on Trade in Goods, according to Article 4, "shall prevent a State Party from concluding or maintaining preferential trade arrangements with Third Parties, provided that such trade arrangements do not impede or frustrate the objectives of this Protocol, and that any advantage, concession, or privilege granted to a Third Party under such arrangements is extended to other State Parties on a reciprocal basis."

C.4. What role can the AfCFTA play in advancing the 2030 Agenda for Sustainable Development?

AfCFTA is a key initiative of the African Union's Agenda 2063, which is the continent's own development strategy. The African Union Summit accepted it as an urgent project whose rapid successes and immediate execution will have an influence on socioeconomic development and boost Africans' confidence and commitment as the owners and drivers of Agenda 2063.

The cumulative effect of AfCFTA is to contribute to the achievement of the United Nations 2030 Agenda, in particular, to the Sustainable Development Goals (SDGs), from targets for decent work and economic growth (Goal 8)

and the promotion of industry (Goal 9), to food security (Goal 2) and affordable access to health services (Goal 3).

AfCFTA can aid in lowering Africa's reliance on outside resources by promoting industrialization and economic growth. This would make it possible for Africa to more effectively finance its own development, which is acknowledged by Goal 17.

C.5. What institutions does the AfCFTA establish?

The Assembly, the Council of Ministers, the Committee of Senior Trade Officials, the Secretariat, and numerous technical committees are the entities in charge of carrying out, facilitating, administering, and monitoring the AfCFTA. These institutions rely on consensus to make decisions.

- All AU Heads of State and Government are represented in the African Union Assembly. It oversees and gives strategic direction for the AfCFTA.

- Trade ministers and other State Parties nominations make up the Council of Ministers. It is distinct from the AU's Committee of African Union Ministers of Trade (AMOT). The Council is responsible for ensuring the Agreement's effective execution and enforcement and for taking all necessary steps to advance the AfCFTA's goals. The Executive Council of the AU is the channel via which the Council of Ministers reports to the AU Assembly.

- Permanent Secretaries or other officials chosen by State Parties make up the Committee of Senior Trade Officials. It is in charge of carrying out decisions made by the Council of Ministers, developing programs and action plans to execute the AfCFTA Agreement, and overseeing how the AfCFTA is operating.

- A permanent and operationally independent AfCFTA institution, the Secretariat. It is in charge of a number of administrative and auxiliary tasks to coordinate the AfCFTA's implementation. Its headquarters are in Accra, Ghana. The agreement to host the AfCFTA Secretariat on August 3, 2020, was approved by the Parliament of Ghana.

- The AfCFTA Dispute Settlement Mechanism replicates, with the necessary adaptations, the WTO dispute settlement system. The principles and procedures appear in a dedicated Protocol.

Several technical committees are established by the AfCFTA Agreement's Protocols to help with the Agreement's implementation. The committees are made up of State Parties' appointed representatives. The Protocol on Trade in Goods and its annexes are made easier to use by the Committee on Trade in Goods and its subcommittees. The Protocol on Trade in Services will be operated more efficiently thanks to the Committee on Trade in Services and its 5 subcommittees.

C.6. What are the remaining issues in negotiations on AfCFTA rules of origin?

Outstanding issues in negotiations on AfCFTA rules of origin are (i) Completion of Appendix IV on product-specific rules of origin, with the agreed rules on automotive and textile sectors particularly missing; (ii) Completion of general origin provisions and other issues, summarized in Art. 42 of the updated Annex 2 on Rules of Origin:

(a) Implementing decisions on the definitions of “Value Added” in Article 1 (x) and requirements for “their vessels” and “their factory ships” in Article 5 (2) and criteria and issues pertaining to Special Economic Arrangements / Zones In Article 9 in Annex 2 on Rules of Origin;

(b) Drafting of additional Definitions in Annex 2 on Rules of Origin;

(c) Drafting hybrid rules in Appendix IV to Annex 2 on the Rules of Origin;

(d) Drafting regulations for Goods produced under Special Economic Arrangements / Zones ;

(e) Drafting of additional provisions in Annex 2 on Rules of Origin on value tolerance, absorption principle and accounting segregation/GAAP; and

(f) Drafting AfCFTA Rules of Origin Manuals/Guidelines.

This page was developed following the workshops of November 03 to 10, 2022 delivered for the benefit of the eight Tunisian chambers of commerce and industry as part of awareness-raising on the ATO tool, under the aegis of the Support to Trade Agreements with Africa (AACA) project commissioned by the German Federal Ministry for Economic Cooperation and Development Bundesministerium für wirtschaftliche Zusammenarbeit und Entwicklung (BMZ) and implemented by GIZ Tunisia in partnership with the Ministry of Trade and Export Development.