Incoterms® is an abbreviation for International Commercial Terms, which are a set of trade terms published by the International Chamber of Commerce (ICC), and accepted as well as used by governments, legal authorities, and traders in most major trading nations worldwide.

(Source: ICC website)

Each Incoterms® rule, commonly manifested by a three-letter abbreviation, represents a possible option of distributing responsibilities and obligations for shipping a product between two parties, namely a seller and a buyer, in an international sale contract.

Incoterms® rules enable both contract parties to allocate costs, risks, and responsibilities in performing the contract. They also affect logistics and transportation management to carry the goods from the exporting country to the importing country.

Differences in trading practice and contract interpretation across countries necessitate the need for a common set of rules to clarify the obligations of contracting parties regarding the delivery of goods. Such rules need to be comprehensible to traders worldwide so that they may communicate provisions of sale contracts in a clearer manner, thereby reducing the risk of dispute arising from misinterpretation.

Incoterms® rules, once incorporated into international sale contracts, will define distinct obligations and responsibilities between buyers and sellers regarding the delivery of the goods. When a seller and a buyer agree to refer to a particular Incoterms® rule in their contract, they accept the obligations and responsibilities defined under that rule.

A proper use of Incoterms® rules will enable traders to collaborate more harmoniously, deliver their goods more conveniently, and receive payment more quickly. In this sense, Incoterms® is a major trade facilitating mechanism.

However, there are also limits to Incoterms® rules. They are silent about a number of issues, for instance the price payable or the method of payment used in the transaction. In addition, Incoterms® rules do not deal with such issues as transfer of ownership, breach of contract, or product liability – all of which need to be clarified in the contracts. Besides, Incoterms® rules cannot override applicable laws.

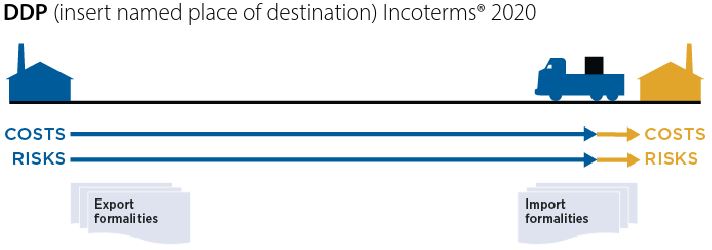

For example, all Incoterms® except DDP require the buyer to pay customs duties upon entry of the good into the country of import. Thus for a customs tariff rate displayed in Market Access Map, it is the Incoterm® chosen by the parties that defines who will pay the tariff at the customs – the seller (if DDP) or the buyer (if any other Incoterms®).

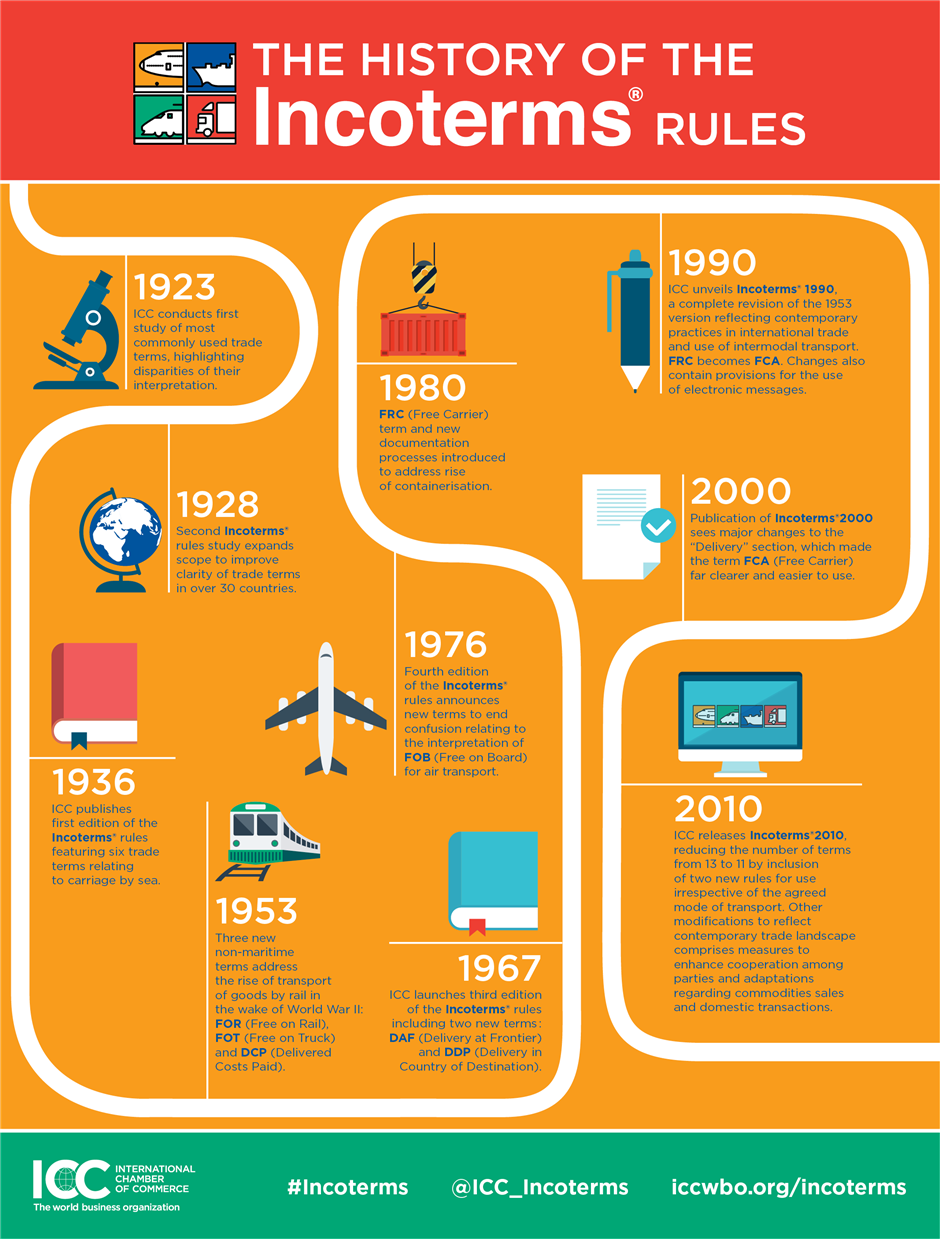

After carrying out comparative studies to understand commercial terms commonly used by merchants, ICC published the first version of Incoterms® in 1936. Since then, ICC has periodically updated the rules to reflect the evolvement of trade practice. To be specific, amendments and additions to Incoterms® were introduced in 1953, 1967, 1976, 1980, 1990, 2000, and 2010. Most recently, ICC has released Incoterms® 2020 in September 2019.[1]

(Source: ICC website)

The latest version of Incoterms®, which consists of 11 rules, will come into effect on January 1 2020. While there is nothing preventing traders from using previous versions of Incoterms®, it is not advisable to do so. If parties to a sale contract do not intend to use the latest version of Incoterms®, they should clearly state the version they refer to, and make sure they adhere to its corresponding obligations throughout the transaction.

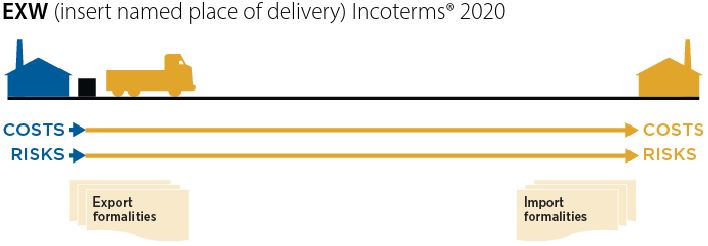

Ex Works (EXW) – The seller fulfils his obligation by placing the goods unloaded at the disposal of the buyer at the seller’s premises or another named place.

(Source: ICC, Incoterms® 2020)

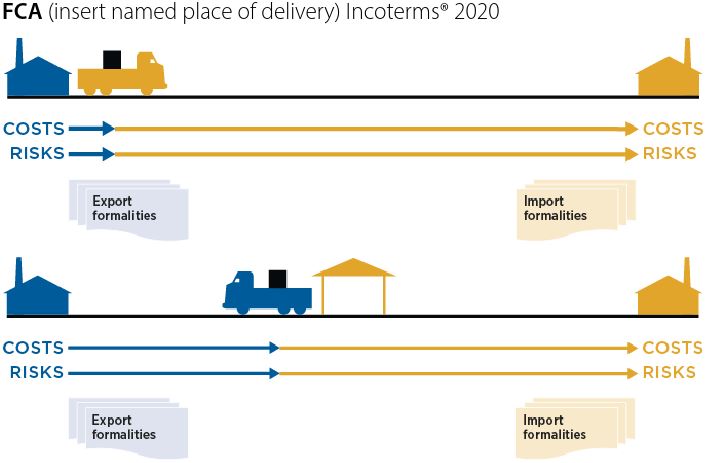

Free Carrier (FCA) – The seller fulfils his obligations by delivering the goods to the carrier or another person nominated by the buyer at the seller promises or another named place.

(Source: ICC, Incoterms® 2020)

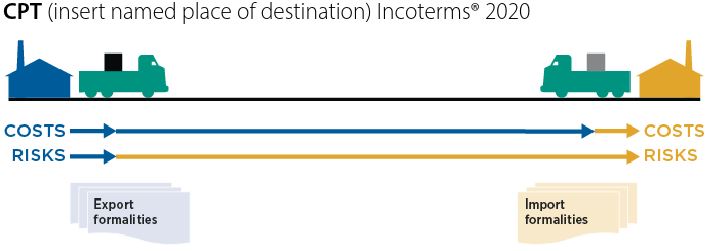

Carriage Paid to (CPT) – The seller fulfils his obligations by delivering the goods to the carrier or another person nominated by the seller at a place agreed between the parties.

(Source: ICC, Incoterms® 2020)

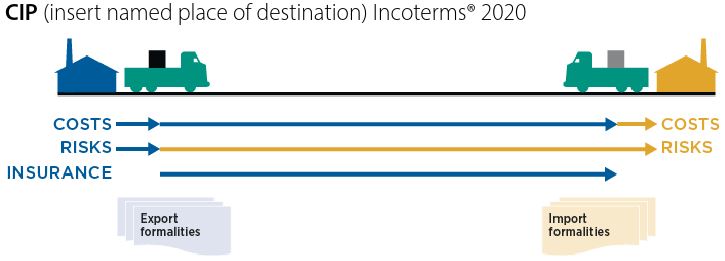

Carrier and Insurance Paid to (CIP) – The seller fulfils his obligations by delivering the insured goods to the carrier or another person nominated by the seller at a place agreed between the parties.

(Source: ICC, Incoterms® 2020)

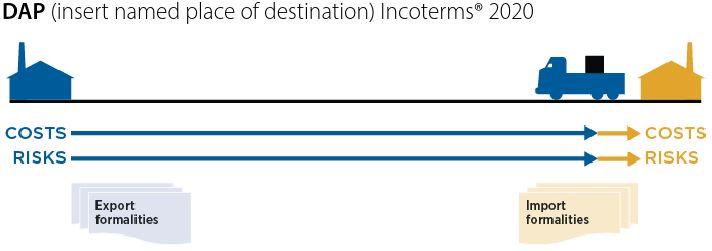

Delivered at Place (DAP) – The seller fulfils his obligations by placing the goods on the arriving means of transport ready for unloading at the disposal of the buyer at the named place of destination.

(Source: ICC, Incoterms® 2020)

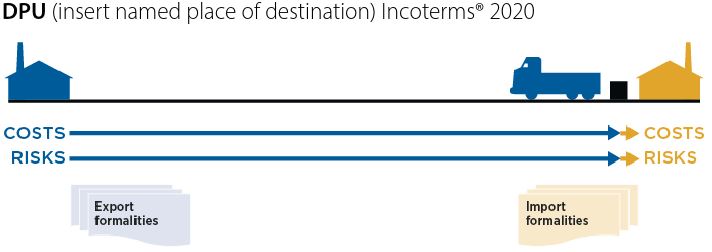

Delivered at Place Unloaded (DPU) – The seller fulfils his obligations by placing the goods unloaded from the arriving means of transport at the disposal of the buyer at a named terminal at the named place of destination.[2]

(Source: ICC, Incoterms® 2020)

Delivered Duty Paid (DDP) – The seller fulfils his obligations by placing the goods cleared for import on the arriving means of transport ready for unloading at the buyer’s disposal at the named place of destination.

(Source: ICC, Incoterms® 2020)

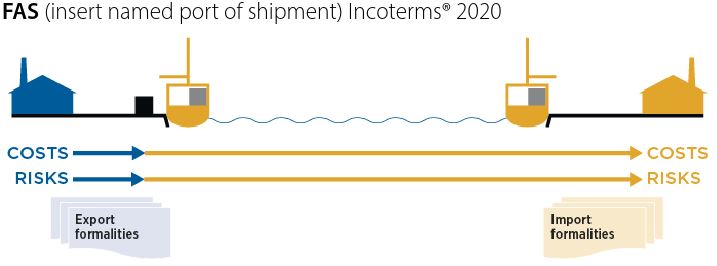

Free Alongside Ship (FAS) – The seller fulfils his obligations by placing the goods alongside the ship nominated by the buyer at the named port of shipment or by procuring the goods so delivered.

(Source: ICC, Incoterms® 2020)

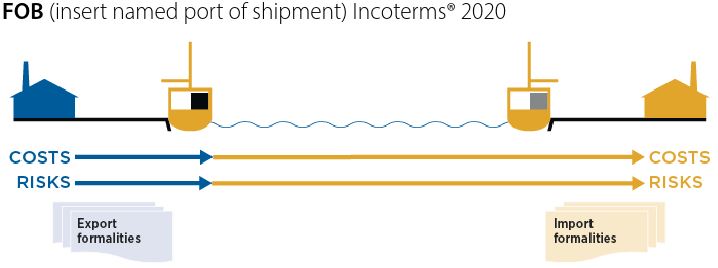

Free on Board (FOB) – The seller delivers the goods by placing the goods on board the vessel nominated by the buyer at the named port of shipment or procured the goods already so delivered.

(Source: ICC, Incoterms® 2020)

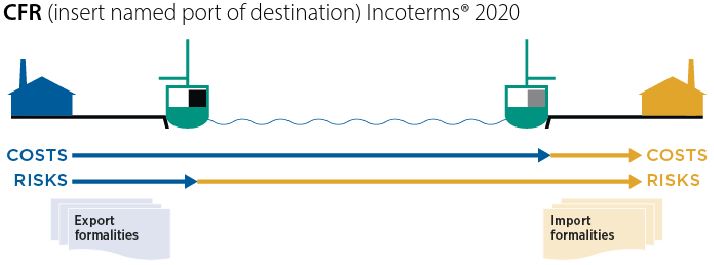

Cost and Freight (CFR) – The seller fulfils his obligations by placing the goods on board the vessel nominated by the seller at the agreed port of loading or by procuring the goods already so delivered.

(Source: ICC, Incoterms® 2020)

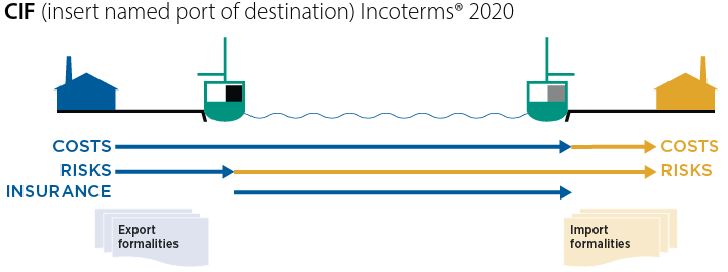

Cost, Insurance and Freight (CIF) – The seller fulfils his obligations by placing the insured goods on board the vessel nominated by the seller at the agreed port of loading or by procuring the goods already so delivered.

(Source: ICC, Incoterms® 2020)

Despite Incoterms® being essentially voluntary rules, governments have been relying on Incoterms® as data elements for implementing trade policies and for customs purposes.

According to Article 1 of the WTO’s Customs Valuation Agreement, the customs value of imported goods is determined based on their transaction value, which is the “price actually paid or payable for the goods when sold for export to the country of importation adjusted in accordance with the provisions of Article 8”.[3]

Depending on the Incoterms® rule used in the contract, certain costs such as of transport-related services and/or insurance must be added or deducted from the invoice amount to obtain the customs value to calculate import duties. For instance, if the contract uses CFR Incoterms® 2020, the seller is under no obligation to insure the goods at his expense. If the buyer does not arrange insurance at his own expense, there is no reason for the customs authority to add insurance cost into the customs value of the imported goods. Whereas if CIF Incoterms® 2020 is used, then the addition of insurance cost to the customs value may be compulsory.[4]

Since Article 8.2 of the Customs Valuation Agreement leaves the adjustments relating to transport and insurance costs at WTO Members’ discretion, some Members, for example the United States, opt to determine customs value of imported goods on an FOB (loading port) basis. It means that there will be a need to make adjustments if Incoterms® rules used in sale contracts are not FOB.[5]

In the field of rules of origin, Incoterms® rules are also relevant in several circumstances.

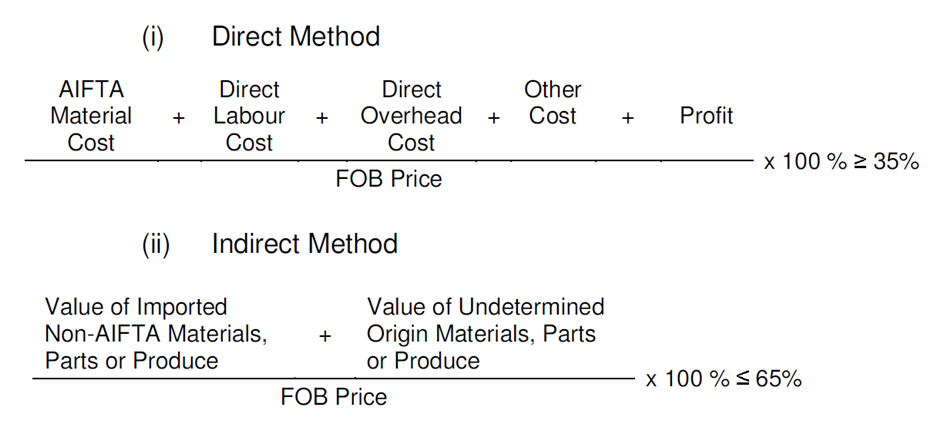

Some common Incoterms® rules are used in the formulas to calculate regional value content or local value content. This content denotes a percentage of added value generated by qualifying working and processing operations as compared to the final value of the goods. The latter is often determined on an EXW basis (as in EU’s free trade agreements) or FOB basis (as in ASEAN’s free trade agreements).

(Source: ASEAN – India Free Trade Agreement)

Incoterms® rules (most commonly CIF) are also mentioned in the method to calculate the values of originating and non-originating materials.[6] Such values are in turn a crucial factor in order to calculate regional value content or local value content.

Although it is not always the case, in principle whenever the value of the goods or materials is taken into account, the Incoterms® basis should be mentioned for the sake of clarity (for instance, in De minimis provision or the provision on exemption of proof of origin).

Since there are more Incoterms® rules than a few ones commonly used in rules of origin, it may be necessary to adjust invoice values accordingly for origin determination purpose.

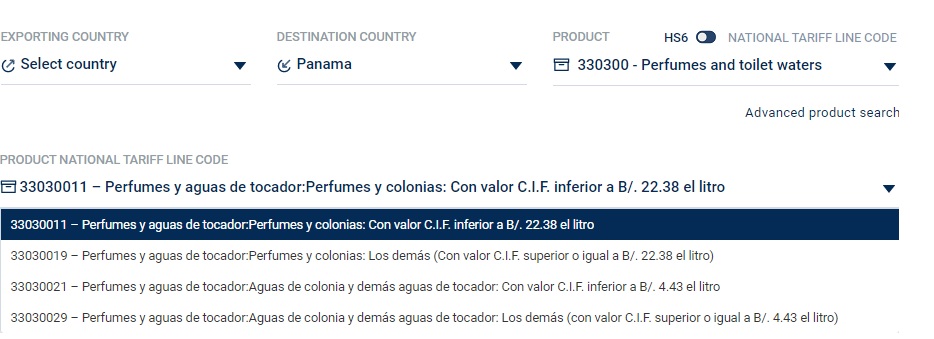

Sometimes, Incoterms® rules are incorporated in the description of products in tariff schedules at the national tariff line level. Some governments adopt different trade policies, such as varying tariff rates, depending on the value of the imported product.

(Source: ITC Market Access Map)

[1] https://iccwbo.org/resources-for-business/incoterms-rules/incoterms-rules-history/

[2] The DPU rule replaces the DAT (Delivered at Terminal) rule, which was first introduced in Incoterms® 2010. It is one of the most important changes in this 2020 revision.

[3] https://www.wto.org/english/docs_e/legal_e/20-val_01_e.htm#ArticleI

[4] Contrary to a common misinterpretation, transaction value as defined by the Customs Valuation Agreement is not equal to CIF.

[5] https://www.shippingsolutions.com/blog/everything-has-a-value-to-u-s-customs

[6] Indeed, there is a risk of disharmony if rules of origin require such value to be calculated on a CIF basis, which may be against the principle to respect the transaction value of imported goods.